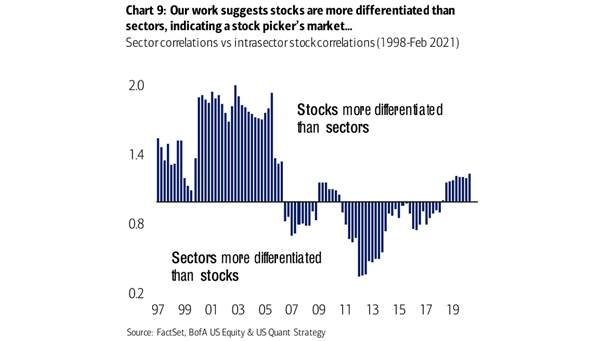

Stocks – Sector Correlations vs. Intrasector Stock Correlations

Stocks – Sector Correlations vs. Intrasector Stock Correlations The fact that stocks are more differentiated than sectors bodes well for stock pickers. Image: BofA US Equity & Quant Strategy