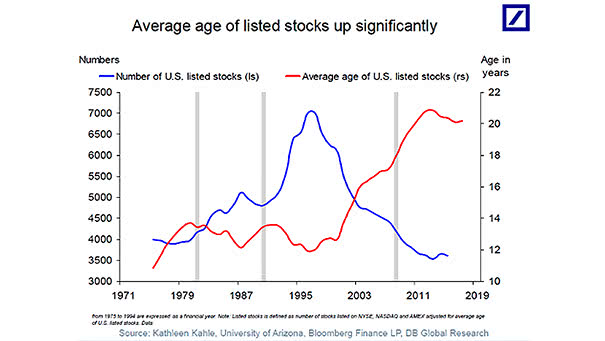

Number of U.S. Listed Stocks and Average Age of U.S. Listed Stocks

Number of U.S. Listed Stocks and Average Age of U.S. Listed Stocks The U.S. stock market is shrinking. The number of firms listed on U.S. stock exchanges has fallen by nearly 50% since 1996. Image: Deutsche Bank Global Research