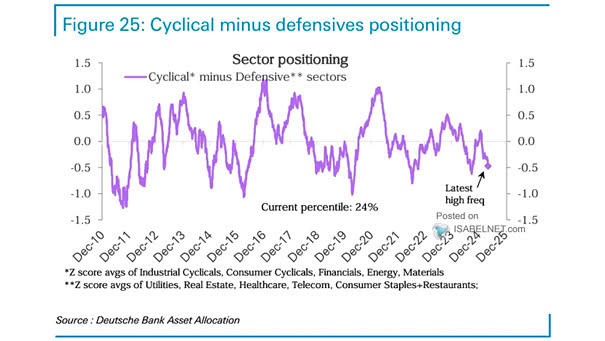

Cyclical Minus Defensive Sectors Positioning

Cyclical Minus Defensive Sectors Positioning The cyclical-minus-defensive sectors positioning at the 24th percentile indicates a defensive market stance, with investors heavily favoring sectors less sensitive to the economic cycle. Image: Deutsche Bank Asset Allocation