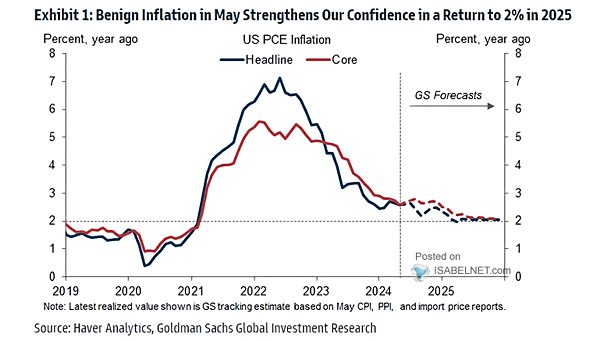

U.S. Headline Inflation and U.S. Core PCE inflation

U.S. Headline Inflation and U.S. Core PCE inflation According to Goldman Sachs, U.S. PCE inflation is expected to converge to the 2% target by 2025, potentially leading to a more predictable and stable economic environment for U.S. consumers. Image: Goldman Sachs Global Investment Research