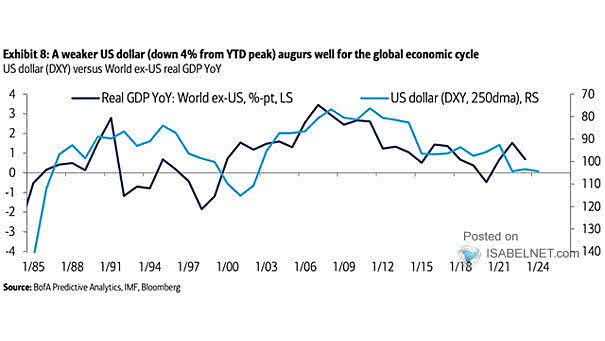

U.S. Dollar Index and Rest of the World GDP

U.S. Dollar Index and Rest of the World GDP A weaker U.S. dollar typically bodes well for the global economy by boosting growth prospects, improving trade dynamics, and encouraging investment in international markets. Image: BofA Predictive Analytics