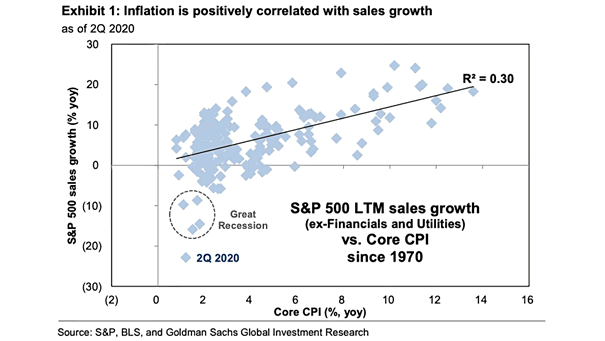

Inflation – S&P 500 LTM Sales Growth vs. Core CPI Since 1970

Inflation – S&P 500 LTM Sales Growth vs. Core CPI Since 1970 Rising inflation tends to boost S&P 500 earnings. According to Goldman Sachs, a 100bp increase in average annual core CPI would lift the S&P 500 EPS to $170 in 2021. Image: Goldman Sachs Global Investment Research