Apr

06

2019

Off

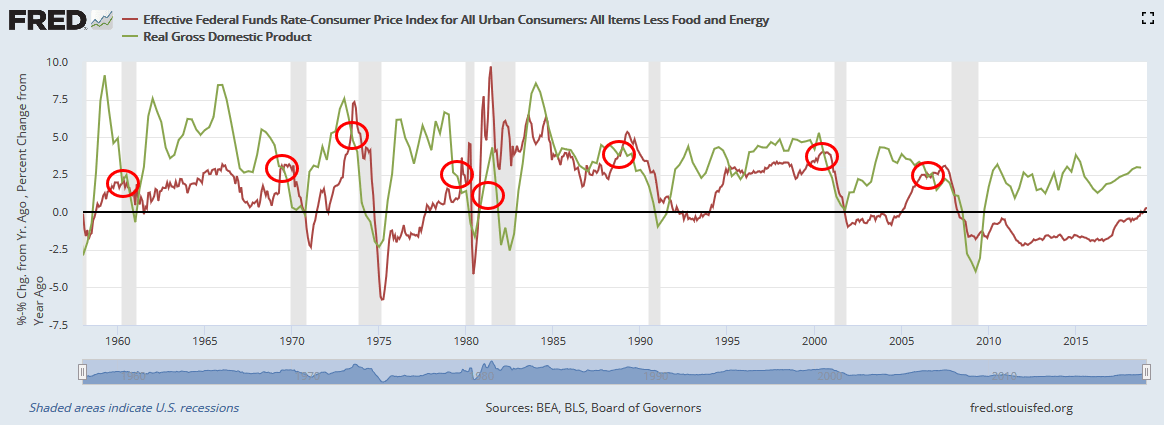

Real GDP vs. Real Fed Funds Rate

One of our most favorite charts is the real GDP vs. the real Fed funds rate (adjusted for inflation). Historically, recessions begin when the real Fed Funds rate exceeds GDP growth.

We are far from that today. So, this cycle should not end any time soon.

The real Fed funds rate is a very good measure of how tight or loose monetary policy is. The real Fed funds rate is the “true cost” of borrowing money. Recessions have always been preceded by a substantial tightening of monetary policy, which, in real terms, matter most.