Apr

08

2019

Off

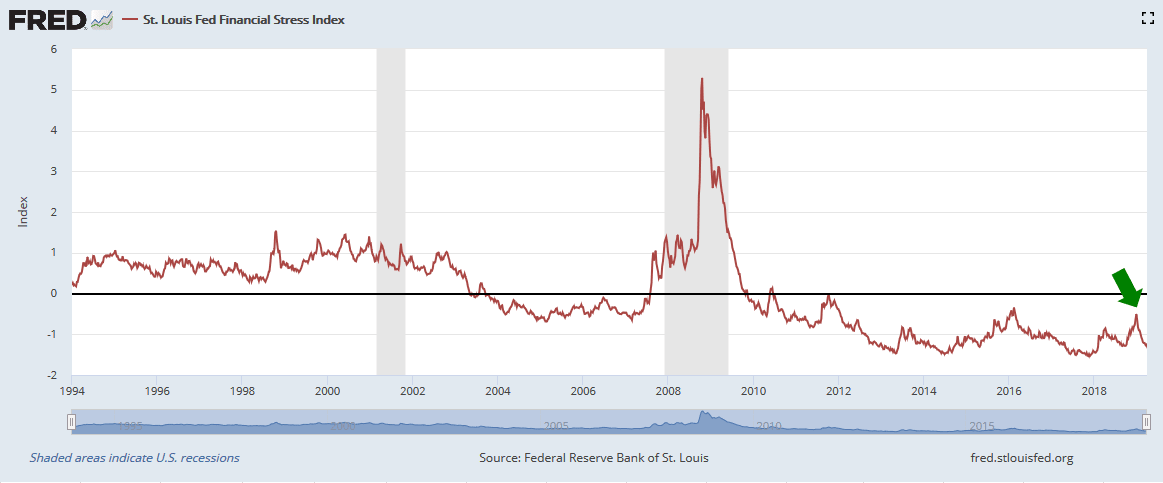

St. Louis Fed Financial Stress Index

Before a coming recession, also watch the St. Louis Fed Financial Stress Index for forecasting the future.

It uses 18 weekly data series to measure financial stress in the market: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress.

The average value of the index is designed to be zero since 1993. Thus, zero representing normal financial market conditions, a value below zero suggests below-average financial market stress, and a value above zero suggests above-average financial market stress.

Close to its lowest level today, is good news for the US economy.