May

29

2019

Off

US Yield Curve Inversions since 1966

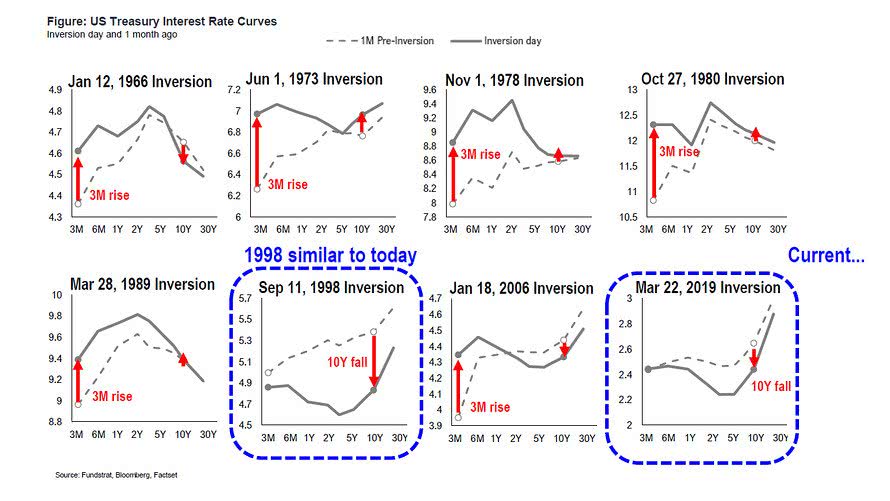

Currently, investors are concerned about yield curve inversions, because they have been a indicator of a coming recession.

But not all inversions are the same. If the yield curve inversion is due to 10-year falling, then it is a “risk-off” trade, and not an economic cycle turn. This great chart below shows that the current 10-year/3-month inversion resembles 1998. At that time, it was a buying opportunity.

Image: Fundstrat Global Advisors, LLC