What Indicators to Watch for Signs a U.S. Recession Is Coming?

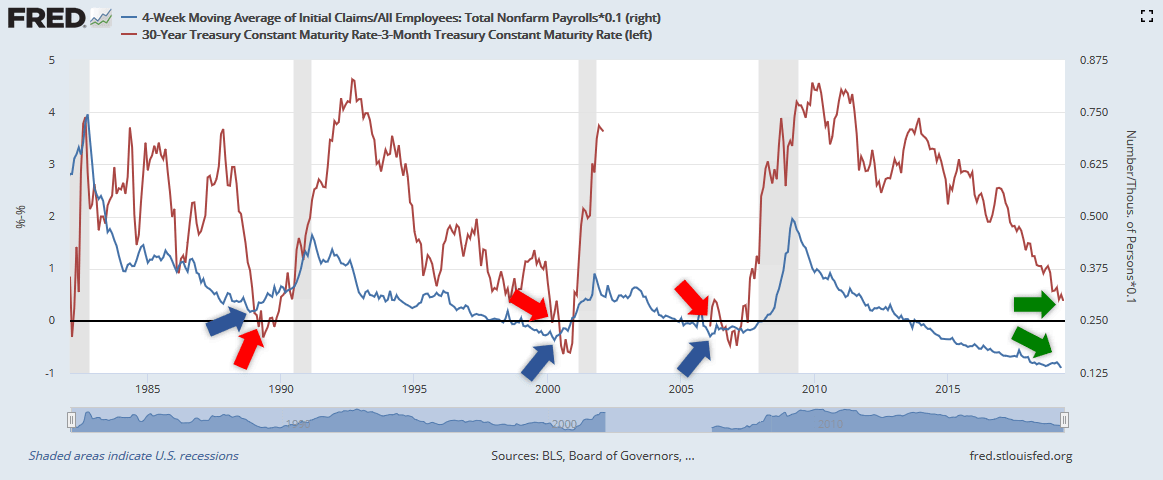

1) In recent history, a recession occurs about 12 to 18 months after the spread between the 30-year and the 3-month treasury yields turns negative (red arrow).

When an inverted yield curve occurs, short-term interest rates exceed long-term rates. It suggests that the long-term economic outlook is poor and that the yields offered by long-term fixed income securities will continue to decline. Since 1962, no recession has occurred without an inverted yield curve.

Keep in mind that an inverted yield curve doesn’t guarantee recession, we also need a widening of credit spreads and high real interest rates.

2) The probability of being unemployed in a given month in the United States, by dividing the average initial claims for unemployment

insurance by the total number of people working, is one of the best indicators to monitor for signs a U.S. recession is coming (blue arrow).

When the probability of being unemployed marks a low point, a U.S. recession is coming.

Today, these two indicators combined suggest no imminent recession on the horizon (green arrow).