Apr

22

2019

Off

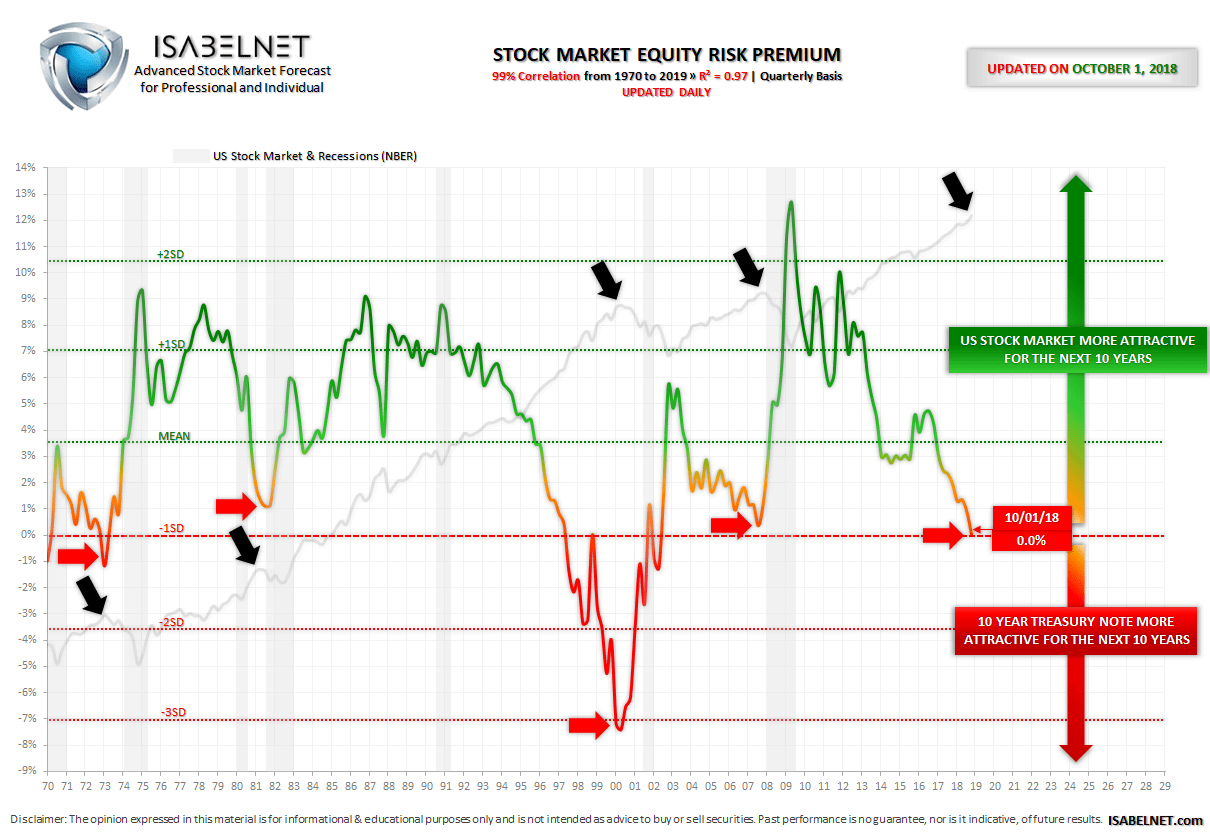

Why a Low or Negative Equity Risk Premium Coincides with a Temporary Market Peak?

Because it pushes investors into bonds rather than equities. This was the case in 1973, 1981, 2000, 2007 and 2018 before the market crash. The current equity risk premium is available to our subscribers.

Our equity risk premium model has a great 96% correlation with the US stock market on a quarterly basis since 1970 and an R² of 0.92.