May

06

2019

Off

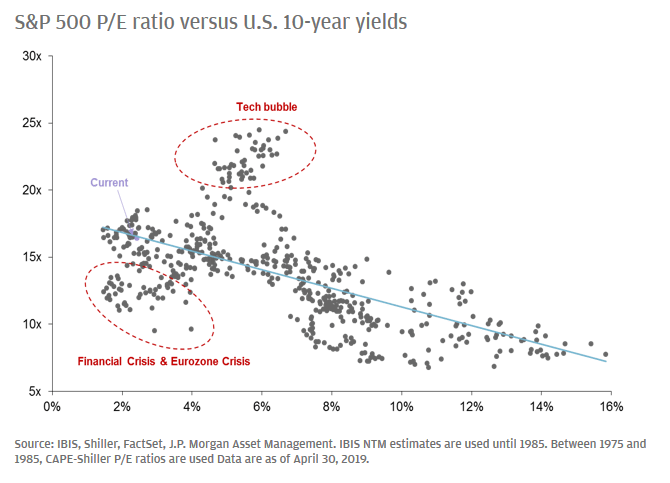

Why Lower Bond Yields Influence the S&P 500?

Because lower interest rates push stock market multiples higher.

If interest rates are lower, then the value of future cash flows increases, because future cash flows are discounted back at a lower interest rate. So, lower U.S. 10-year yields influence the stock market equity risk premium. On the other hand, Warren Buffett likes to say that higher interest rates “act on asset values like gravity acts on physical matter.”

The question to ask yourself: will long-term interest rates remain very low for a long period of time?

Picture Source: J.P. Morgan Asset Management