Apr

22

2019

Off

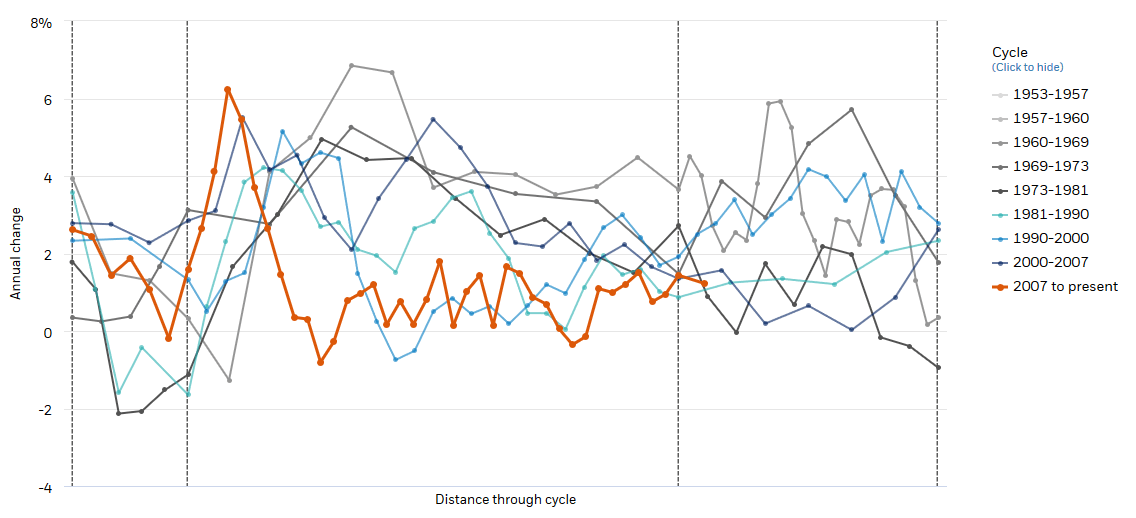

Why U.S. Productivity Is Lower Than Previous Business Cycles?

The real yield is the most important measure of financial tightness.

But as the real yield is near zero, artificially low interest rates are then associated with unnecessary debt, zombie firms and lower productivity than previous business cycles. Zombie firms cannot invest, innovate and increase productivity.

U.S. productivity is also lower due to the bipolarization of the labor market, with the replacement of industrial jobs by unsophisticated service jobs that pay low wages. Finally, the growing number of companies in dominant positions reduces productivity in the United States.

Image: Blackrock