Why Warren Buffett says that stocks are generally better than bonds?

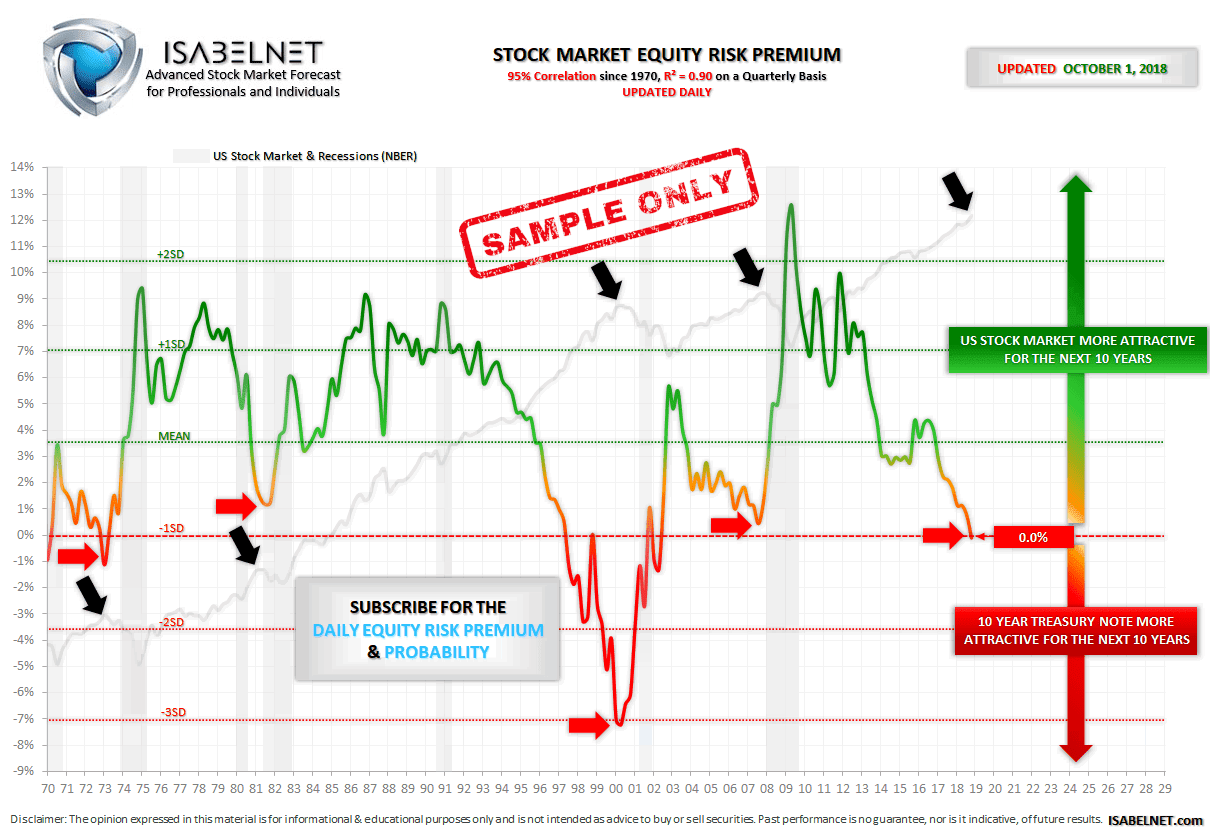

Our equity risk premium model shows when the US stock market return for the next 10 years is more or less attractive than the 10-Year Treasury Note.

Since 1970, the 10-year Treasury Note was less attractive than the US stock market over a 10-year period, except in 1972-1973, and 1997-2002 during the internet bubble. So, over the last 50 years, Warren Buffett is right when he says that stocks are generally better than bonds.

Note that on 10/01/2018, the equity risk premium = 0%, just before the stock market crash. Is it just a pure coincidence? Not at all.

Our equity risk premium model has a great 96% correlation with the US stock market on a quarterly basis since 1970 and an R² of 0.92. For more information, we invite you to see the video tutorial of the equity risk premium.