Jun

07

2019

Off

Yield Curve Inversion, How Long Until The Recession?

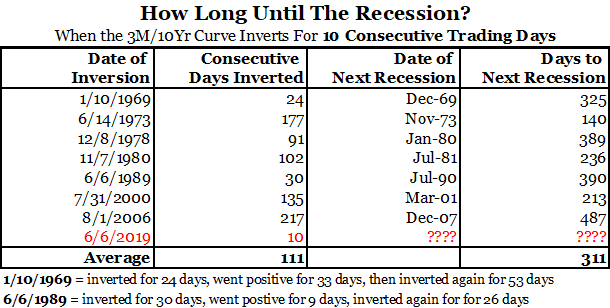

In recent history, once the 10-Year minus 3-Month Treasury yield spread is negative and hits 10 consecutive days, it persists for weeks/months.

When an inverted yield curve occurs, short-term interest rates exceed long-term rates. It suggests that the long-term economic outlook is poor and that the yields offered by long-term fixed income securities will continue to decline. Since 1962, no recession has occurred without an inverted yield curve.

Image: Bianco Research