Apr

30

2019

Off

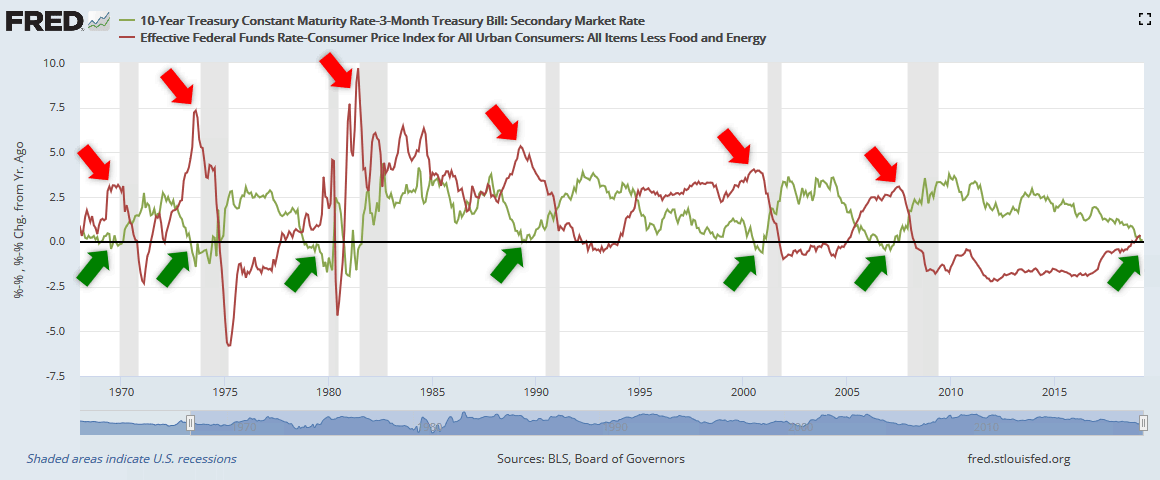

Yield Curve vs. Real Fed Funds Rate

In modern history, every recession was preceded by an inverted yield curve and high real interest rates. When an inverted yield curve occurs, short-term interest rates exceed long-term rates. It suggests that the long-term economic outlook is poor and that the yields offered by long-term fixed income securities will continue to decline. Since 1962, no recession has occurred without an inverted yield curve.

A yield curve inversion is a necessary condition, but it’s not a sufficient condition because we also need higher real interest rates. The real Fed funds rate is the “true cost” of borrowing money.

Today, monetary policy is not restrictive and suggests there’s no imminent recession ahead.