Jan

12

2026

Off

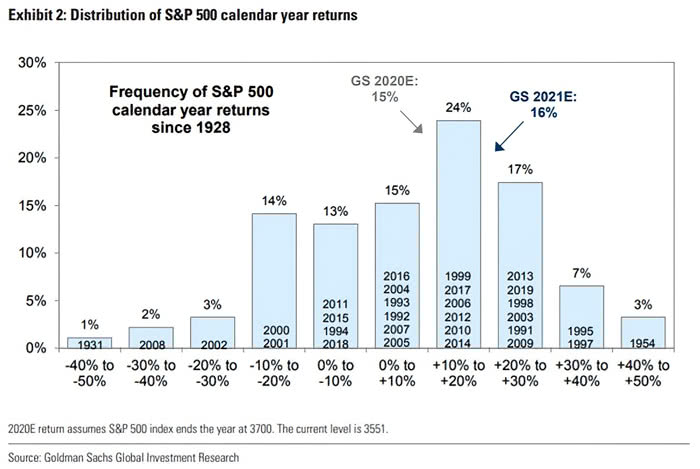

Distribution of 1-Year S&P 500 Returns in Non-Recession Years

Double‑digit losses are a rarity outside recessions, just 5% of the time. But when growth kicks in, the S&P 500 usually surges, notching double-digit gains nearly 70% of the time and ending higher in 85% of those years.

Image: Carson Investment Research