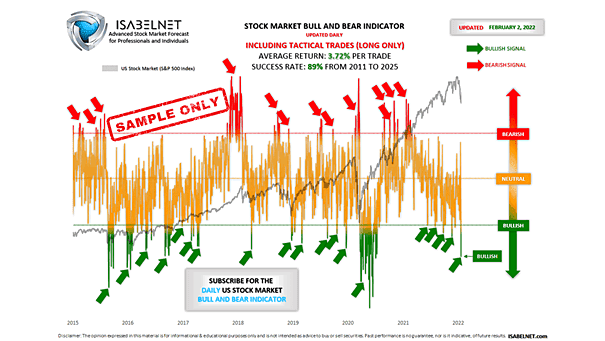

U.S. Stock Market Bull and Bear Indicator – S&P 500

U.S. Stock Market Bull and Bear Indicator – S&P 500 On Monday of last week, our Stock Market Bull & Bear Indicator was bullish well before the opening bell and the S&P 500 followed through, closing up 0.54%. Using multiple financial data, this great model helps investors navigate through different market conditions. It suggests whether…