U.S. IPO Market

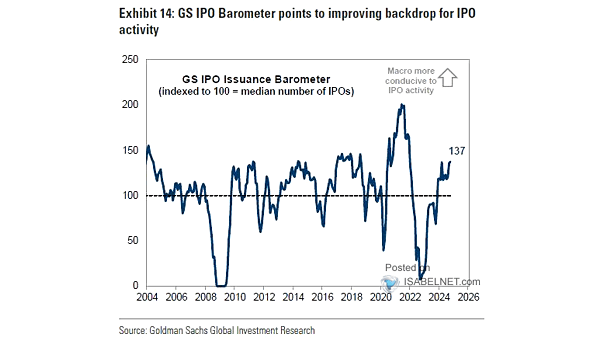

U.S. IPO Market The GS IPO Issuance Barometer, which shows improvement, suggests that the U.S. IPO market could be ready for a robust recovery in 2025 after several years of decreased activity. Image: Goldman Sachs Global Investment Research