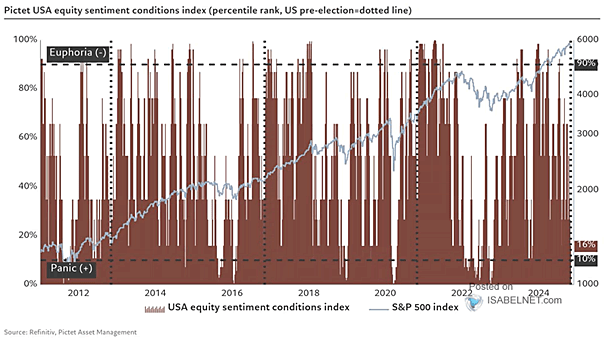

U.S. Equity Sentiment Conditions Index

U.S. Equity Sentiment Conditions Index U.S. equity sentiment appears to be at relatively depressed levels heading into the 2024 U.S. presidential election, due to heightened uncertainty, market volatility, and concerns about potential policy shifts. Image: Pictet Asset Management