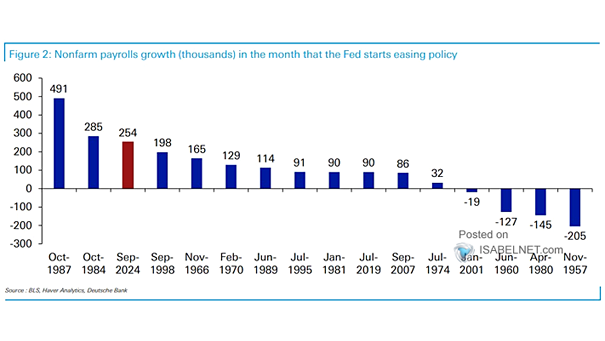

U.S. Labor Market – Nonfarm Payrolls Frowth in the Month That the Fed Starts Easing Policy

U.S. Labor Market – Nonfarm Payrolls Growth in the Month That the Fed Starts Easing Policy The recent rise in payroll numbers is surprising given the Fed’s easing of interest rates. Usually, strong job growth coincides with tighter monetary policy, but the current situation reveals a notable divergence. Image: Deutsche Bank