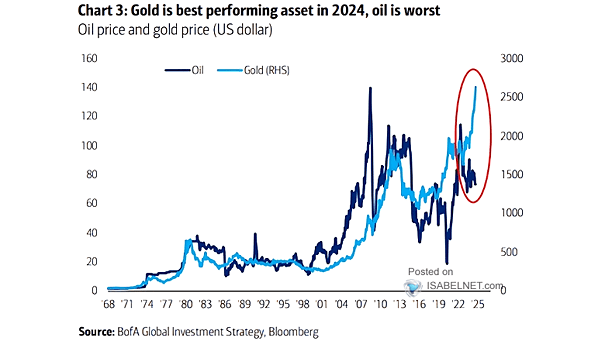

WTI Crude Oil to Gold Ratio

WTI Crude Oil to Gold Ratio Gold shines as the best-performing asset of 2024 for those looking for stability and inflation protection, while oil faces significant challenges from shifting demand patterns. Image: BofA Global Investment Strategy