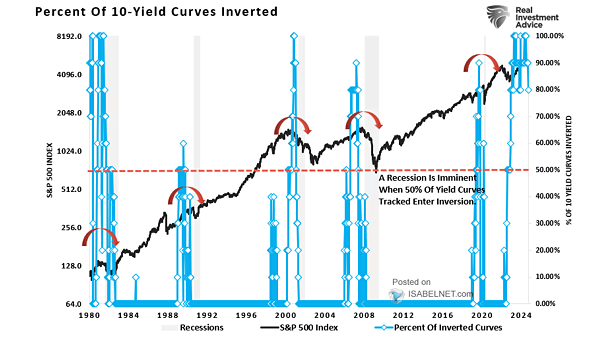

Percent of 10 Yield Curves Inverted

Percent of 10 Yield Curves Inverted Historically, inverted yield curves have successfully anticipated every recession in the United States, highlighting their importance as an economic indicator. Will this time be an exception? Image: Real Investment Advice