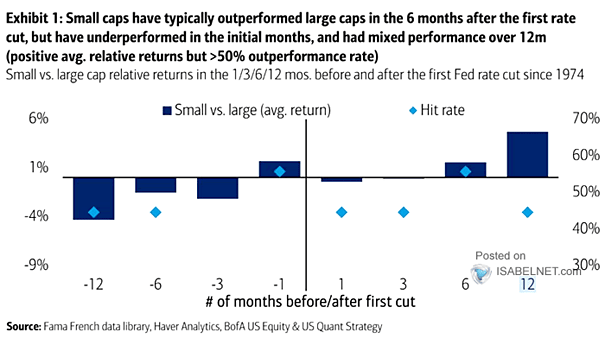

Small-Cap Stocks Relative Performance vs. Large-Cap Stocks Around the First Fed Rate Cut

Small-Cap Stocks Relative Performance vs. Large-Cap Stocks Around the First Fed Rate Cut Small-caps often outperform large-caps in the 6 months following the first Fed rate cut, driven by lower interest rates and a market preference for smaller companies during economic recoveries. Image: BofA US Equity & Quant Strategy