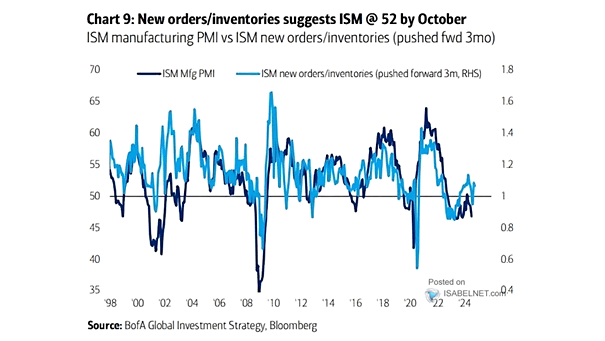

ISM Manufacturing PMI and ISM New Orders – Inventories

ISM Manufacturing PMI and ISM New Orders – Inventories The spread between U.S. ISM New Orders and Inventories suggests a positive upward trend in the ISM manufacturing PMI, with new orders increasing at a more rapid pace than inventories. Image: BofA Global Investment Strategy