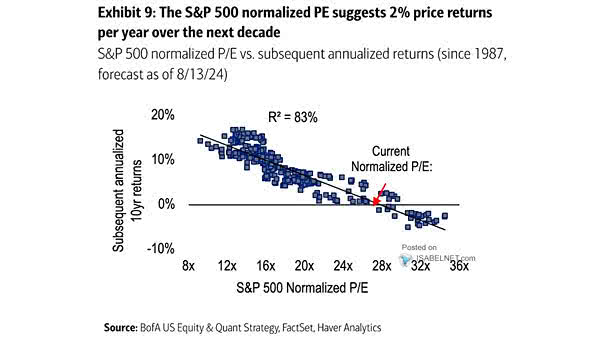

S&P 500 Normalized P/E vs. Subsequent Annualized Returns

S&P 500 Normalized P/E vs. Subsequent Annualized Returns Current high valuations in the U.S. stock market, particularly within the technology sector, suggest that investors may face lackluster returns over the next decade. Image: BofA US Equity & Quant Strategy