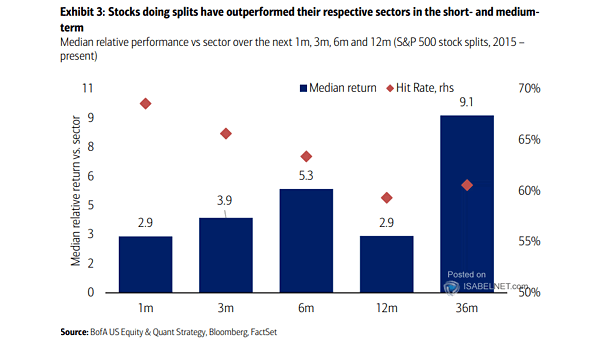

S&P 500 Stock Splits – Median Relative Performance vs. Sector

S&P 500 Stock Splits – Median Relative Performance vs. Sector While stock splits do not inherently change a company’s value, the increased investor interest they generate often leads to short and medium-term outperformance relative to the sector. Image: BofA US Equity & Quant Strategy