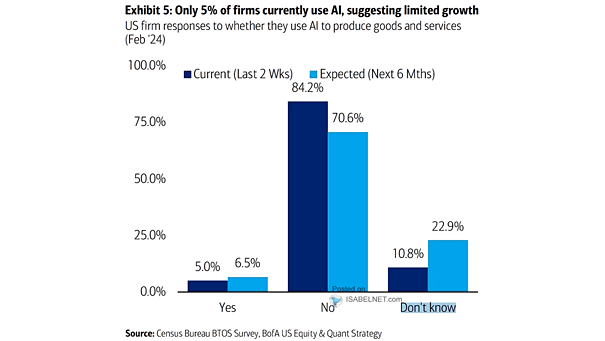

U.S. Firms Responses to Whether They Use AI to Produce Goods and Services

U.S. Firms Responses to Whether They Use AI to Produce Goods and Services Currently, only 5% of U.S. firms use AI to produce goods and services, but this figure is expected to grow as more companies recognize the potential benefits of AI technologies. Image: BofA US Equity & Quant Strategy