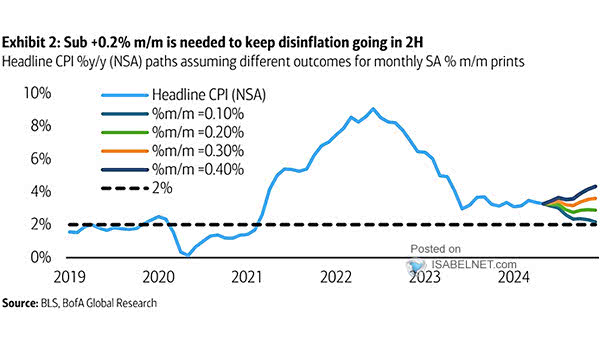

Inflation – U.S. CPI Forecasts

Inflation – U.S. CPI Forecasts With inflation high, the Fed’s interest rate cut decisions require a delicate balance between price stability, economic expansion and employment support. Image: BofA Global Investment Strategy