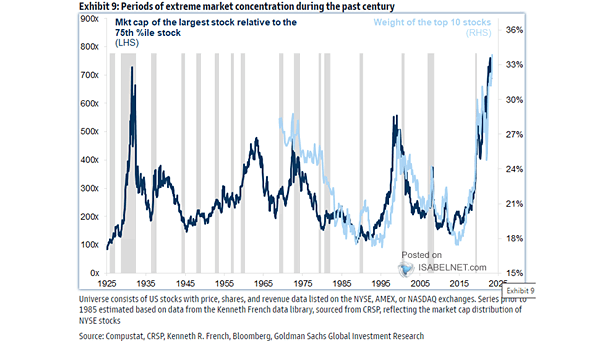

Top 10 Stocks as % of S&P 500

Top 10 Stocks as % of S&P 500 In recent years, there has been a substantial rise in concentration among the top 10 companies in the S&P 500, which has raised concerns about potential risks to investors. Image: Goldman Sachs Global Investment Research