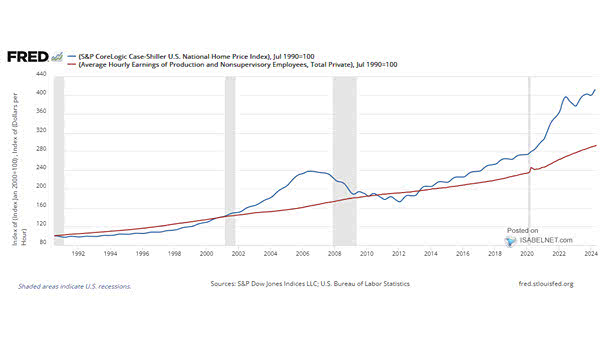

Wage Growth vs. U.S. Home Price Growth

Wage Growth vs. U.S. Home Price Growth The widening gap between U.S. home prices and wage growth has significant implications for housing affordability and economic inequality, making it harder for lower-income individuals and families to afford homes. Image: Federal Reserve Bank of St. Louis