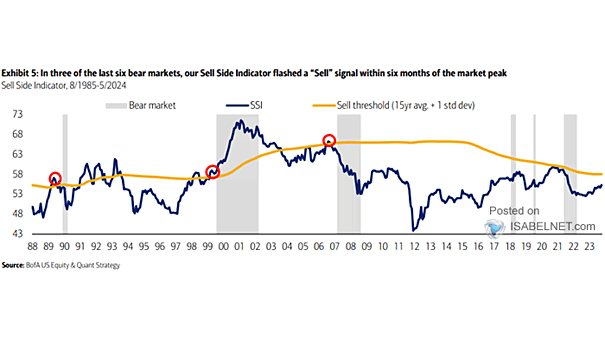

Sell Side Indicator (Average Recommended Equity Allocation by Wall Street Strategists)

Sell Side Indicator (Average Recommended Equity Allocation by Wall Street Strategists) The Sell Side Indicator, which tracks Wall Street strategists’ equity allocation recommendations, remains in neutral territory, with no sell signal triggered. Image: BofA Global Research