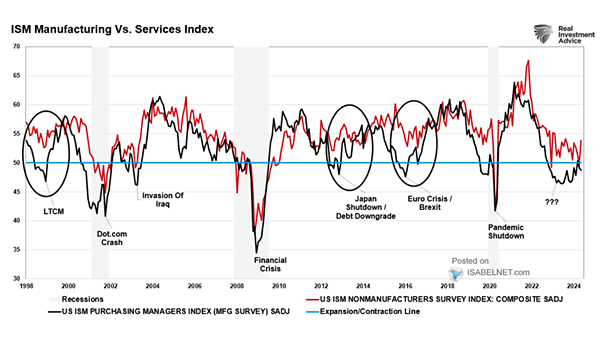

U.S. ISM Manufacturing and Services Survey Data

U.S. ISM Manufacturing and Services Survey Data A “soft recession” occurs when the manufacturing side of the U.S. economy contracts while services remain robust, leading to a period of slower economic activity. Image: Real Investment Advice