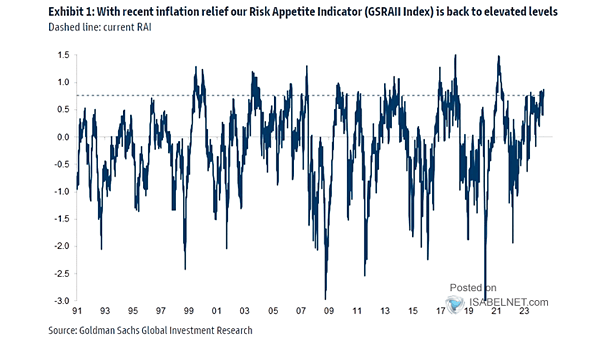

Risk Appetite Index

Risk Appetite Index As investors embrace a more aggressive stance, the risk appetite indicator is back to elevated levels, signaling a willingness to take on higher levels of risk for potentially greater returns. Image: Goldman Sachs Global Investment Research