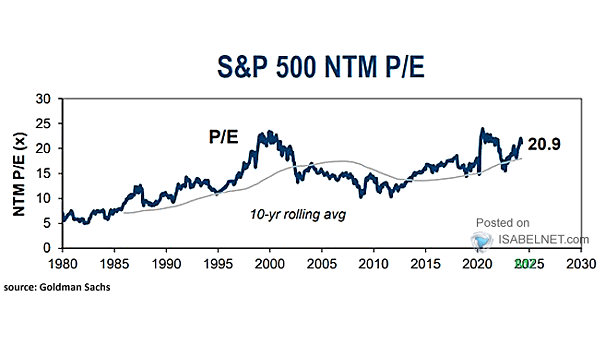

Valuation – S&P 500 Next-Twelve-Month P/E Ratio

Valuation – S&P 500 Next-Twelve-Month P/E Ratio The S&P 500 NTM P/E ratio is currently at a high level of 20.9, indicating that investors are willing to pay a relatively high price for each dollar of expected earnings in the next twelve months. Image: Goldman Sachs Global Investment Research