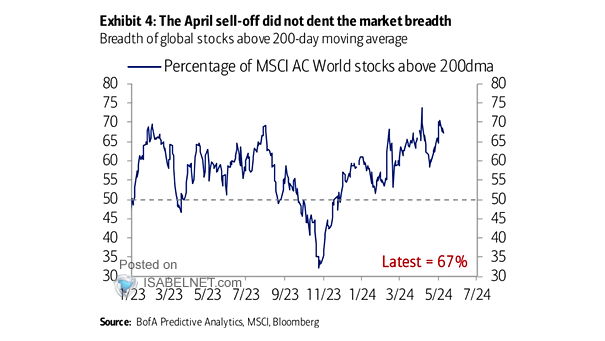

Market Breadth – Percentage of MSCI AC World Stocks Above 200-Day Moving Average

Market Breadth – Percentage of MSCI AC World Stocks Above 200-Day Moving Average The decline in prices and selling pressure in April did not have a negative impact on the breadth of the market. Image: BofA Predictive Analytics