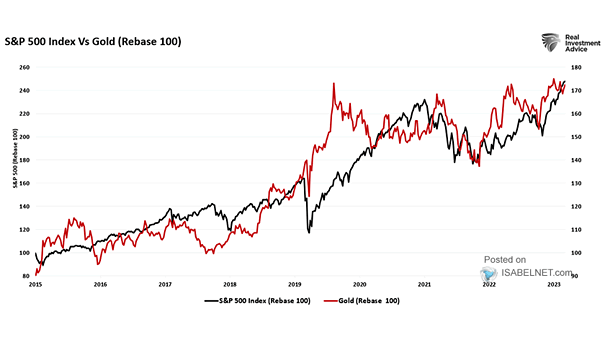

Gold Price vs. S&P 500 Index and Recessions

Gold Price vs. S&P 500 Index and Recessions Throughout history, gold has been considered a safe haven during market declines. Since 2015, its correlation with U.S. stocks has strengthened, making it more likely for gold to move in sync with U.S. stocks during market downturns. Image: Real Investment Advice