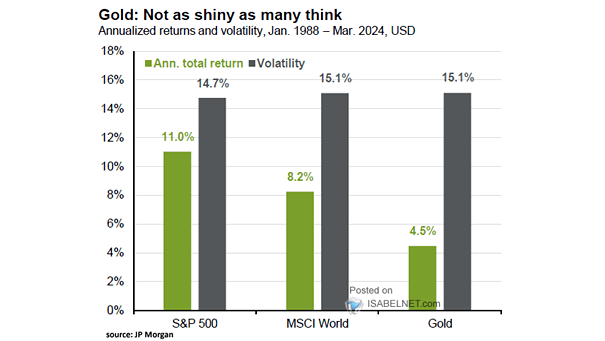

Gold Annualized Returns and Volatility

Gold Annualized Returns and Volatility While gold has had periods of significant growth and can serve as a hedge against inflation, historical data suggests that equities have generally outperformed gold over the long term. Image: J.P. Morgan