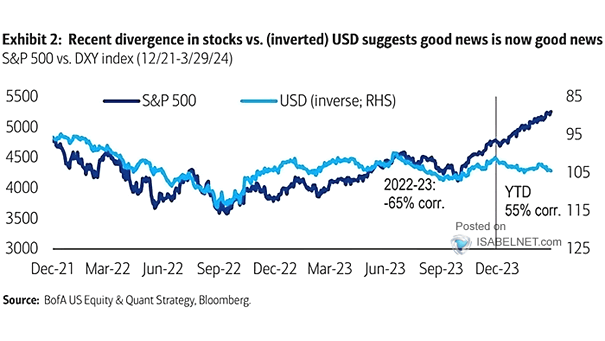

U.S. Dollar vs. S&P 500

U.S. Dollar vs. S&P 500 The market is responding positively to good news, as indicated by the recent divergence between the S&P 500 and the U.S. dollar (inverted). This suggests a renewed sense of optimism in the market. Image: BofA US Equity & Quant Strategy