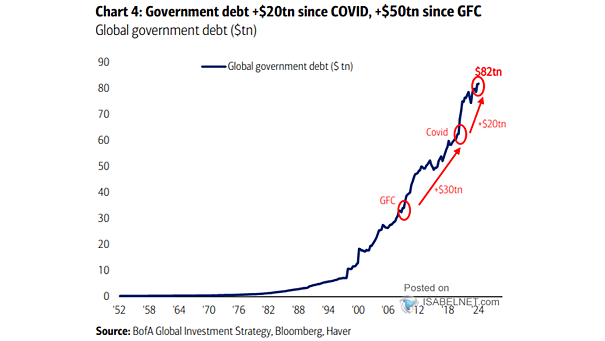

Global Government Debt

Global Government Debt Global government debt has skyrocketed since the global financial crisis, reaching its highest level in peacetime and posing significant challenges and vulnerabilities for governments and economies worldwide. Image: BofA Global Investment Strategy