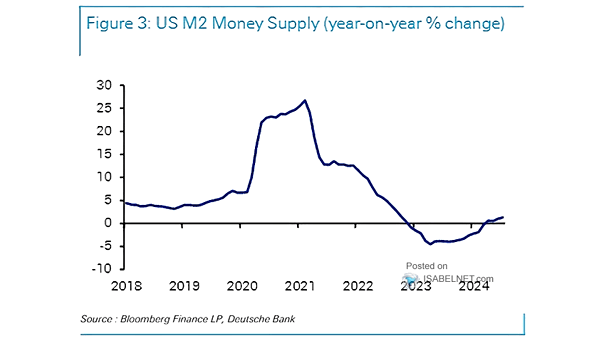

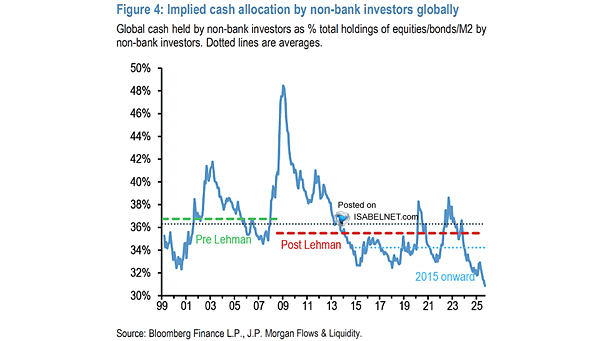

U.S. M2 Money Creation by Year

U.S. M2 Money Creation by Year All signs point to a 2026 liquidity wave: bigger money funds, solid bank credit, and $40 billion a month from the Fed in T‑bill buys. That could juice reserves, pump up nearly $2 trillion in money creation, and keep stocks humming. Image: J.P. Morgan Flows and Liquidity