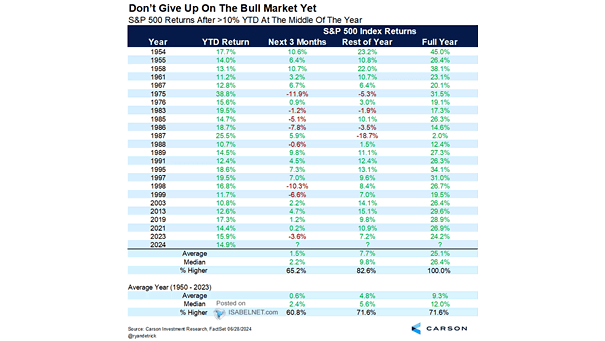

S&P 500 Returns After >10% YTD at the Middle of the Year

S&P 500 Returns After >10% YTD at the Middle of the Year Since 1950, when the S&P 500 index has been up more than 10% at the middle of the year, the full year has been positive 100% of the time with a median gain of 26.4%. Image: Carson Investment Research