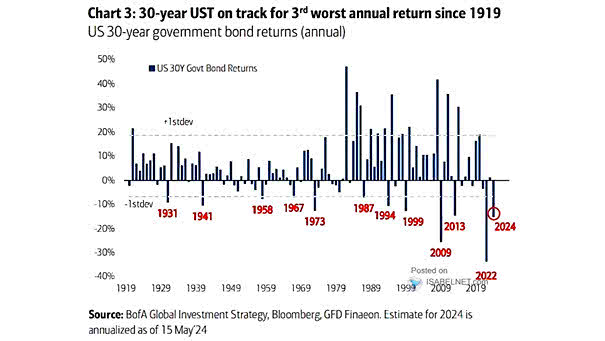

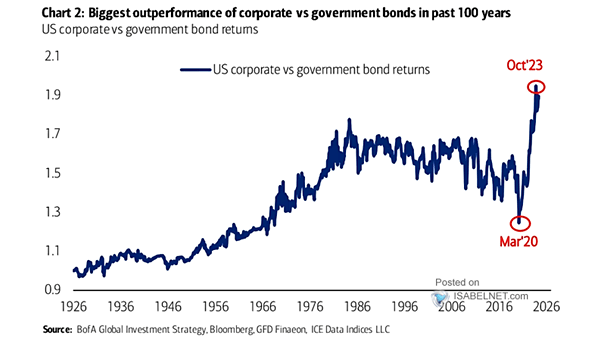

U.S. 30-Year Government Bond Returns

U.S. 30-Year Government Bond Returns The 30-year U.S. Treasury bond is currently experiencing a challenging period in terms of its annual return, as it is on track for the 3rd worst annual return since 1919. Image: BofA Global Investment Strategy