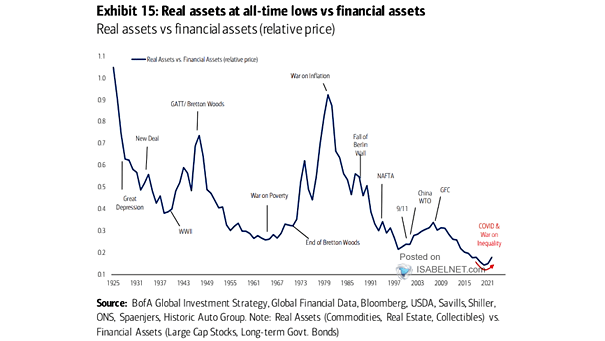

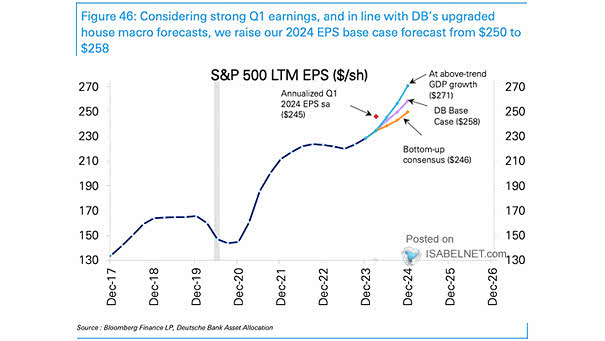

Valuation – Real Assets vs. Financial Assets

Valuation – Real Assets vs. Financial Assets The price of real assets relative to financial assets being very low suggests that investors should consider owning more real assets, such as real estate and precious metals. Image: BofA Global Research