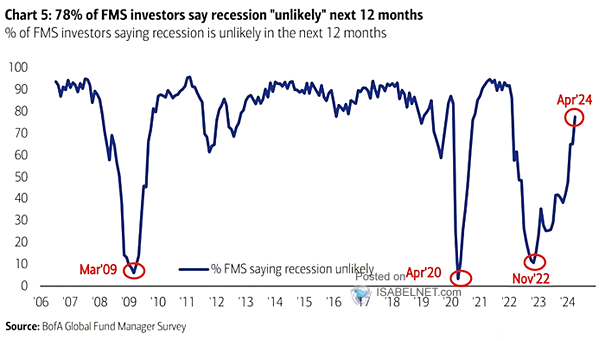

FMS Investors – Net % Saying Recession Likely

FMS Investors – Net % Saying Recession Likely The outlook among FMS investors regarding the possibility of a global recession in the near future is characterized by a much greater sense of optimism. Image: BofA Global Fund Manager Survey