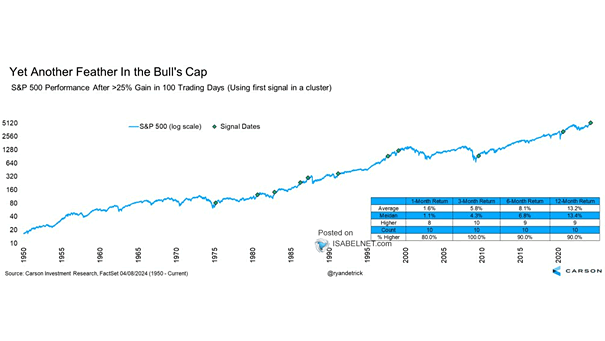

S&P 500 Performance After >25% Gain in 100 Trading Days

S&P 500 Performance After >25% Gain in 100 Trading Days An increase of 25% or more in the S&P 500 within 100 days (using the first signal in a cluster) suggests a positive outlook for the next 12 months, historically resulting in a median gain of 13.4% since 1950. Image: Carson Investment Research