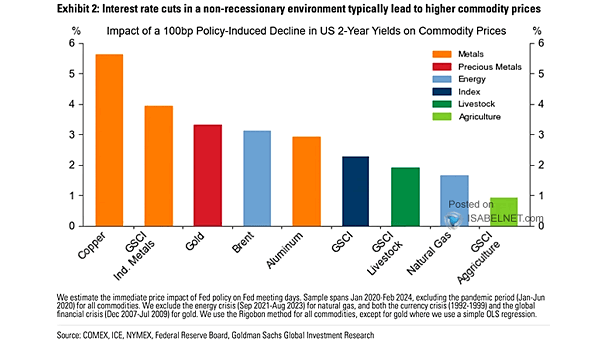

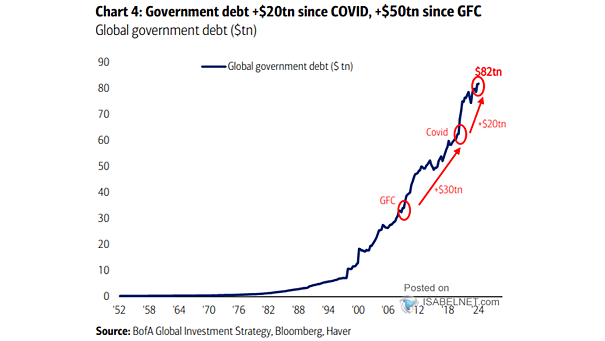

Commodities – Commodity Prices

Commodities – Commodity Prices In a non-recessionary environment, lower U.S. interest rates can lead to an increase in commodity prices, particularly metals, gold, and brent crude oil. Image: Goldman Sachs Global Investment Research