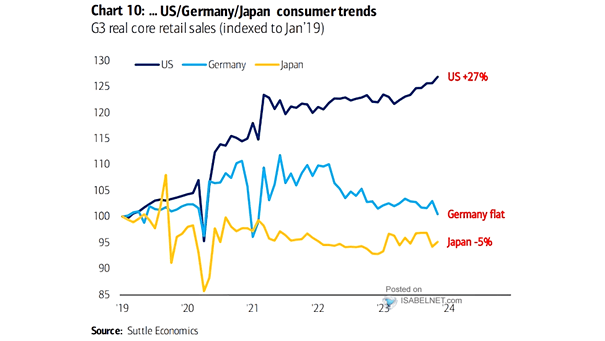

G3 Real Core Retail Sales

G3 Real Core Retail Sales Since 2019, real core retail sales in the United States have risen significantly, while Germany has seen stagnant growth and Japan has witnessed a decline, reflecting differing economic conditions and consumer behaviors. Image: BofA Global Research