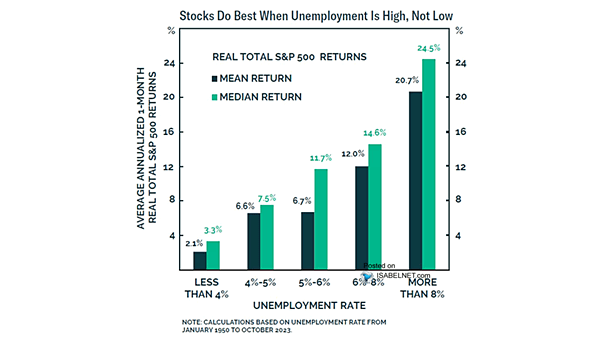

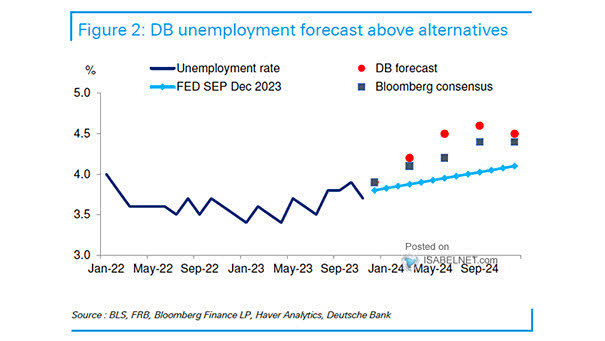

Average Annualized 1-Month Real Total S&P 500 Return and U.S. Unemployment Rate

Average Annualized 1-Month Real Total S&P 500 Return and U.S. Unemployment Rate While a low U.S. unemployment rate is generally a positive indicator for the economy, very low unemployment rates can be seen as a negative for U.S. stocks. Image: BCA Research