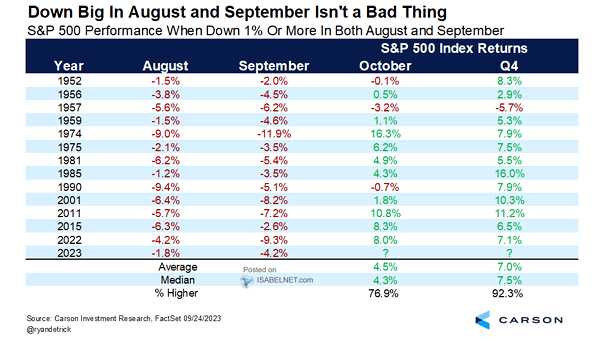

S&P 500 Performance When Down 1% or More in Both August and September

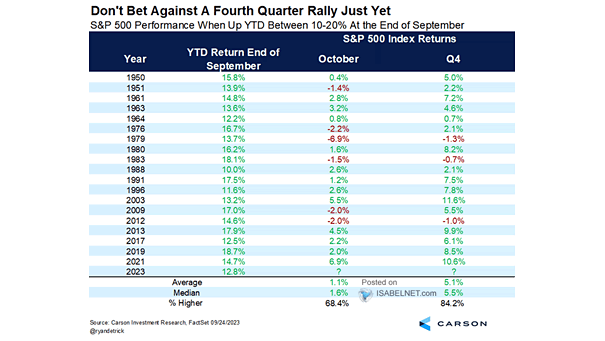

S&P 500 Performance When Down 1% or More in Both August and September Historically, after a decline of 1% or more in both August and September, the S&P 500 tends to rebound in October and perform well in Q4, suggesting that a temporary setback in late summer is often followed by a period of recovery…